Savings Se Investment Tak

What is savings?

Savings is the money left in your bank account after all your regular and discretionary expenses. Your regular living expenses include food, rent / EMI, utilities (electricity, phone, broadband etc), fuel, school fees for children etc. Your discretionary spending may include restaurants bills, movie tickets, clothes, appliances, gadgets, vacations etc. Savings is necessary for your financial security, facing emergencies, meeting your different life-stage goals and wealth creation.

Importance of savings

Savings is a part of ancient Indian cultural traditions. The ancient Indian philosopher Chanakya’s Arthashastra, alludes to importance of savings. Chanakya writes in Arthashastra, “Save your wealth against future calamity... when riches begin to forsake one, even the accumulated stock dwindles away.” Indians are traditional savers, but in recent years with rising consumerism, there is a propensity to spend more on consumption especially among young people. It may be useful to remind investors of the savings advice given by legendary American investor, Warren Buffet, “Do not save what is left after spending, but spend what is left after saving.” However, while savings is necessary for wealth creation, savings by itself will not create wealth for you.

Why saving is not enough?

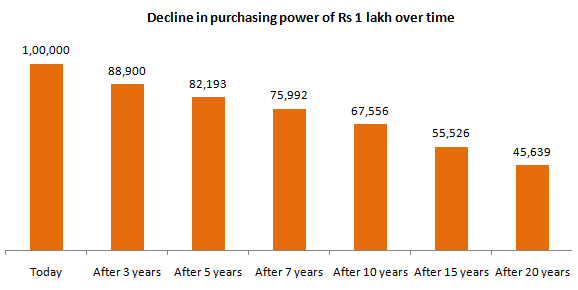

- Inflation is the ugly nine letter word which erodes the purchasing power of money in the long term. The value of Rs 1 lakh saving today will be lower in terms of purchasing power 3 years from now and will progressively decline over time (please see the chart below). You can see that the purchasing power of Rs 1 lakh today, is just Rs 67,000 after 10 years (assuming inflation rate of 4%) and just Rs 45,000 after 20 years (assuming inflation rate of 4%).

![Decline in purchasing power of Rs 1 lakh over time Decline in purchasing power of Rs 1 lakh over time]()

- Unless your money grows at a rate faster than inflation, you will see the economic value of your money eroding, instead of growing. In other words, your money needs to grow at a faster rate than the rate of inflation, if you want to achieve your financial goals.Such expenditure items e.g. higher education, medical expenses etc in the typical consumption basket of average middle income or upper middle income Indians have inflated at much higher rate than average CPI inflation over the past 10 years. Therefore, your savings has to grow at a much faster rate than the CPI inflation rate.

- If you keep your savingslying in your saving account, then your savings will grow at a much slower rate than inflation. The savings bank interest rates in major public and private sector banks are in the range of 3 to 3.5% (source: SBI, ICICI Bank, HDFC Bank). So if you are keeping your savings idle in your savings bank account, you are actually eroding your wealth on an inflation adjusted basis.

- The other issue with traditional savings e.g. bank savings and deposits, Government small savings schemes etc is taxation. Most traditional savings products are taxed as per the income tax rate of the investor. Since the returns of these products are low on an inflation adjusted basis, post tax returns are even lower for investors in the higher tax brackets. Investments like stocks, bonds, mutual funds etc are much more tax friendly options.

You need to invest to meet create wealth

- Investment refers to putting your funds to productive use by earning a higher rate of return. Return is the profit (capital appreciation) or income (interest, dividends etc) from your invested capital.

- A common observation about many Indian households is that, while we are good savers, we are not wise investors. Many Indian households prefer to invest most of their money in risk-free assets like bank deposits, Government small savings schemes etc. The key difference between saving and investing is returns. You should understand that returns from risk-free assets are the lowest returns. Risk free returns are often lower than inflation rate on a post tax basis.

Suggested reading: how market linked products are better than fixed interest products for wealth creation

- If your return on investment is higher than the inflation rate over the length of your investment tenure you can create wealth for meeting your different financial goals e.g. home purchase, children’s higher education, children’s marriage, retirement planning, leaving a estate for your loved ones etc.

- Chanakya has written about the importance of investing in Arthashastra, “Accumulated wealth is saved by spending well in business or in charity or by investing it profitably, just as a reservoir is kept fresh by letting out the stagnant water”.

Risk and returns in investing

Risk and returns are interrelated; you will have to take some risks to get higher returns. For example, current 5 year Fixed Deposit interest rates of major public and private sector banks are in the range of 6.1 – 6.4% (source: Bank Bazaar, as on 26th October 2022). For investors in the highest bracket post tax returns will be 4.4 – 4.5%, which is barely higher than RBI’s long term inflation target of 4%. Some asset classes, on the other hand, have the potential of generating returns much higher returns than inflation and create wealth for you. For example, Nifty 50 TRI, has give 12.95% CAGR returns over the last 10 years ending 30th September 2022 (source: National Stock Exchange, Advisorkhoj Research). You should always take risk into consideration when investing. Different investors have different risk appetites. You should always invest according to your risk appetite.

Power of compounding in investments

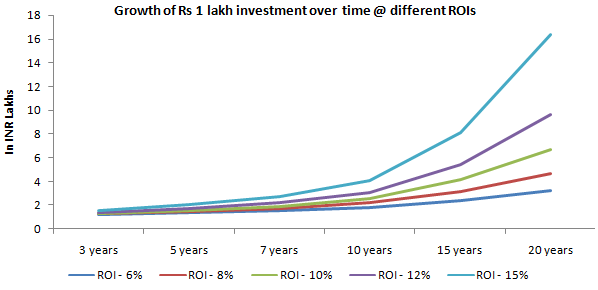

Compounding is profit earned on profits or interest on interest. Time (investment tenure) is the important factor in the power of compounding. The chart below shows the growth of Rs 1 lakh investment at different rates of returns depending on the asset type that you are investing in. The earlier you start investing in the right asset, higher is your wealth creation potential.

How to approach investments?

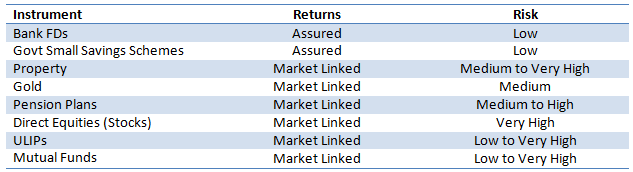

Different types of investment products have different risk return profiles (please see the table below)

You should have the following considerations in making informed investment decisions:-

- Different financial goals – for shorter goal time-lines, you should take lower risks and for longer goal timelines, you can take higher risks.

- Investment objectives – if your investment objective is regular income, you should take lower risk. For capital appreciation over sufficiently long investment horizon, you may take higher risks.

- Your stage of life – younger investors may take higher risks compared to older investors.

- Your risk appetite – different investors have different risk appetites depending on their age, financial situation and investment experience. You should invest according to your risk appetite

- Your liquidity needs – different investment products have different liquidity profiles e.g. Public Provident Fund provides limited liquidity before maturity (15 years), open ended mutual fund schemes can be redeemed at any time, subject to exit loads. You should invest according to your needs.

Mutual funds are ideal investment solutions for retail investors

Mutual funds can cater to a vast spectrum of investment needs and risk profiles ranging from low (e.g. overnight funds) to very high (e.g. equity funds). There are mutual funds which are suitable for parking your idle funds for a few days or months, e.g. overnight funds, liquid funds. On the other end of the spectrum, are mutual fund schemes e.g. equity funds where you can invest for the long term e.g. 10 years or longer. Mutual funds provide risk diversification and investment expertise to manage your investments in different macro-economic and market circumstances. Mutual funds can give you exposure to different asset classes e.g. equity, fixed income or debt, gold, international equity, REITs etc. Mutual funds can serve variety of investment needs like capital appreciation / wealth creation, regular income, tax planning etc. Mutual funds offer different ways of investing e.g. lump sum, systematic investment plans (SIPs) etc, depending on your financial situation and investment needs.

Savings Ka Smarter Tareeka

Some investors may not be comfortable with risk. They usually prefer the safety of savings bank or fixed deposit. You should know that mutual funds are not just for wealth creation. Mutual funds also provide low risk investment solutions for conservative investors. Instead of parking your idle funds in savings bank account or FDs, you can invest in money market mutual fund. Money market mutual funds invest in overnight securities and money market instruments like CPs, CDs, and Treasury Bills etc. Money market mutual funds are suitable for a range of investment tenures from a few weeks / months to a year or longer. They are highly liquid and have the potential of giving higher returns than savings bank or FDs - the yields of 3 months to 1 year G-Secs range from 6.4% - 6.9%. One can save better with almost similar liquidity and relatively better returns thru money market mutual funds.

You should consult with your mutual fund distributor, if you need any help in understanding what your needs are and making the right investment decision according to your needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Magnum Midcap Fund: 22X times growth since inception

- SBI Multicap Fund: Strong performance recovery

- SBI Multi Asset Allocation Fund: Power of Multi Asset Allocation in Volatile Markets

- SBI Multi Asset Allocation Fund: Power of multi asset allocation in volatile market

- SBI Multicap Fund: Off to a great start

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY